Last month, we examined Tipmont’s reliability and found that 2015 was one of Tipmont’s most reliable years to date, reducing our outages by 41 percent from 2014.

A big part of that success is the significant investment in infrastructure upgrades and our tree-trimming program, which we moved from a six-year to a three-year cycle. We faced a snowstorm on February 24 that caused outages across the Midwest as wet, heavy snow brought trees into contact with power lines. Tipmont never had more than 300 members out at one time, thanks to our commitment to continuous upgrades and improvements. Investments like these are possible in part because of access to low-cost capital and a smart borrowing strategy.

Why we borrow

Utilities have two primary sources of cash to grow, operate and maintain the system: the rates you pay and the money we borrow. Borrowing is necessary to help maintain stable rates. It also helps avoid generational cost-shifting, or recovering the cost of an asset well before its depreciated life ends.

For example, Tipmont periodically needs to add a substation to support growth. Substations last about 40 years and cost up to $3 million to construct. Borrowing the necessary funds to construct the substation and then paying those costs back incrementally over its life ensures that future members who will benefit also contribute to recovering the cost.

Low interest loans from the federal government and the Cooperative Financing Corporation (CFC) are available to electric cooperatives to keep interest costs in check, which in turn keeps your rates affordable.

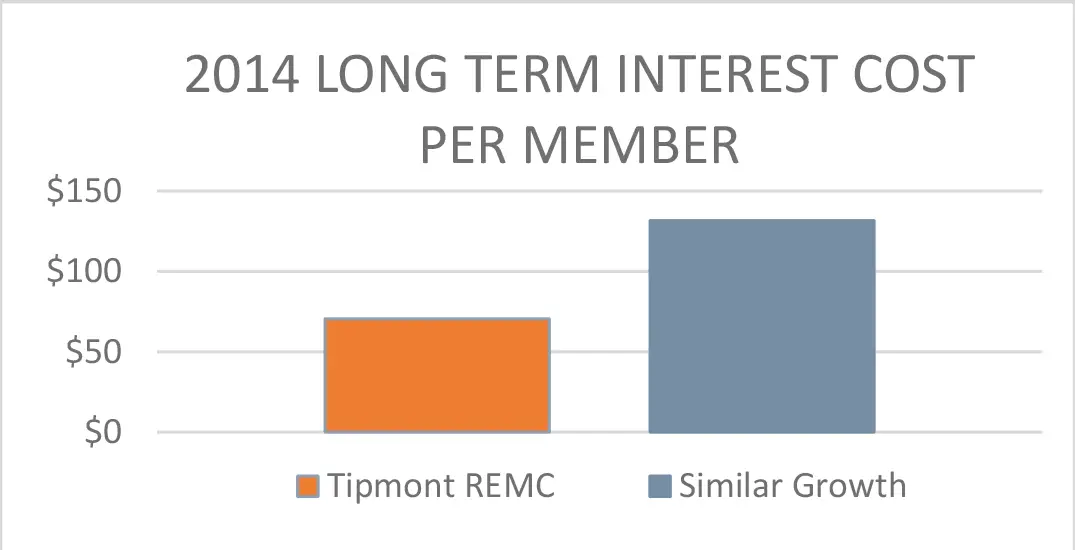

Good borrowing decisions combined with good timing has led to Tipmont’s long-term interest per consumer being nearly 30% lower than the median of all U.S. electric cooperatives in 2014, the latest year that data are available.

An even better comparison is with cooperatives facing the same strong growth as Tipmont, meaning they’re having to invest far more in new service, equipment and other assets. In this category, Tipmont’s interest rates per member are nearly 50% lower than the median (see nearby chart).

An even better comparison is with cooperatives facing the same strong growth as Tipmont, meaning they’re having to invest far more in new service, equipment and other assets. In this category, Tipmont’s interest rates per member are nearly 50% lower than the median (see nearby chart).

Why we’re good at it

So, how did we achieve this? Our finance team watches the borrowing rates constantly with the goal of locking in the lowest possible rates. As a non-profit cooperative, Tipmont is eligible to borrow from the federal Rural Utilities Service (RUS). Borrowing from the federal government means a lot of paperwork and hoops to jump through, but it also means very low interest rates – a key to keeping your rates manageable.

Another key is to make sure our loan portfolio is spread out and that we don’t have any loans that renew at the same time. This helps reduce our risk and take advantage of growth over the long term (also known as dollar cost averaging).

Additionally, staggering the borrowing helps us manage our cash flow by only drawing a portion of the loan when we need it, usually based on the upcoming work plan.

The full cycle

Next month, we’ll look at how a good borrowing strategy leads to more opportunities for creating operating efficiencies – which ultimately leads to a better value for your investment in Tipmont. I’d love to hear any feedback or questions you might have. Email me at ceo@tipmont.org and share your thoughts on how we can continue moving forward together.